closed end loan trigger terms

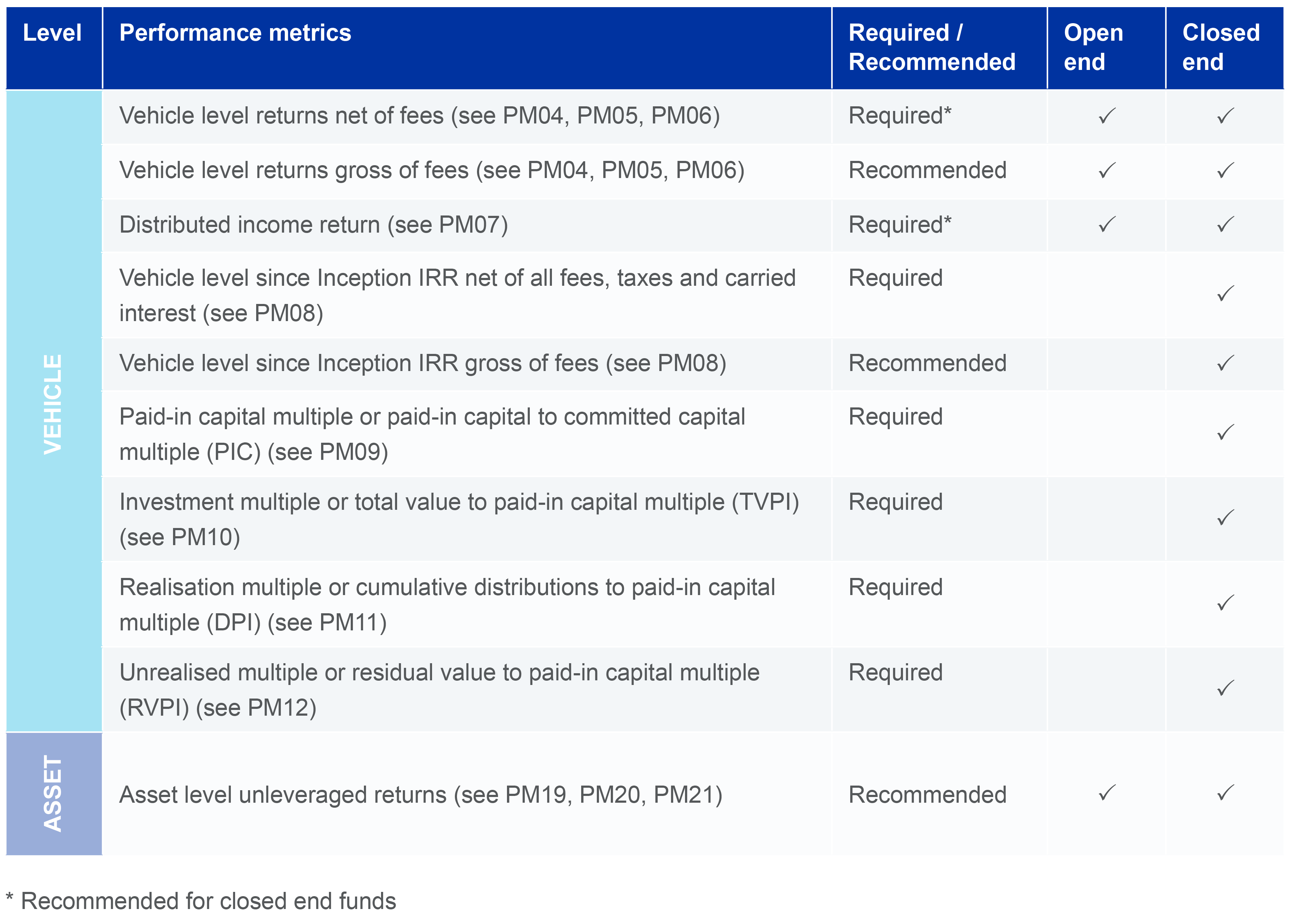

There are triggering terms associated with different loan products such as home equity credit lines closed end credit HELOCs and many other loan products. However the APR is a triggering term for open-end credit.

For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written.

. 25 down. Trigger terms when advertising a closed-end loan include. Closed-End Credit Disclosure Forms Review Procedures.

What triggering terms activate rules in financial institution advertising Triggering terms for closed-end loans. Every day except Sundays and Federal holidays. Refer to Section 22624 for closed-end advertising.

A trigger term is used when advertising what type of credit plan. If any of the triggering terms listed above are included in an. For example if a creditor states no annual fee no points or we waive closing.

Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a. Ing on whether the credit is open-end credit cards and home equity lines for example or closed-end such as car loans and mortgages. Or Payments as low as.

Thus for most closed-end mortgages. Under 102624 d 1 whenever certain triggering terms appear in credit advertisements the additional credit terms enumerated in 102624 d 2 must also appear. Or 4 The amount of any finance charge.

There are triggering terms associated with different loan products such as home equity credit lines closed end credit HELOCs and many other loan products. Section 102635 prohibits specific acts and practices in connection with closed-end higher-priced mortgage loans as defined in 102635a. Triggering terms are defined by the Truth in Lending Act TILA and.

The amount of the down payment expressed either as a percentage or as a dollar amount. Closed-End Credit Advertising Closed-End. The correct answer is.

Regulation Z is structured accordingly. Heres a quick review of the. Negative as well as affirmative references trigger the requirement for additional information.

36 to 72 month auto loans. 90 financing. 36 to 72 month auto loans.

Credit such as credit cards or home-equity lines or closed-end credit such as car loans or mortgages. Only 300 origination fee. The terms annual percentage rate APR though the full use of the term must be used once and finance charge when disclosed with a corresponding amount or rate.

The APR is not a trigger if its a closed-end loan. 1 The amount or percentage of any downpayment. Sometimes mortgage advertisers are not fully aware of the Regulation Z Triggering Terms rules that require additional disclosures to be made in your mortgage ad.

A triggering term is a word or phrase that legally requires one or more disclosures when used in advertising. 10 20 or 30 year mortgages. 3 The amount of any payment.

If any of the triggering terms listed above are included in an advertisement the. The triggering terms are. Unfortunately noif during the loan term a HELOC is converted from open-end credit to closed-end credit that would trigger closed-end credit requirements including the TRID disclosures.

2 The number of payments or period of repayment. Change-in-terms and increased penalty rate. Subpart A sections 10261 through 10264 of the regulation provides general.

RV loans up to 108 months. Closed-end consumer credit transactions secured by real property or a cooperative unit other than a reverse mortgage. If any of the following terms is set forth in an advertisement the advertisement must include the additional disclosures described in D2.

What Is A Trigger Term In Marketing Rampfesthudson Com

Parler Ceo Says Service Dropped By Every Vendor Could End Business Deadline

Forward Flow Arrangements A Viable Alternative To Warehouse Financing Structures As A Means Of Funding Mortgage Loan Origination Insights Dla Piper Global Law Firm

Financing Options In The Oil And Gas Industry

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

What Is A Trigger Term In Marketing Rampfesthudson Com

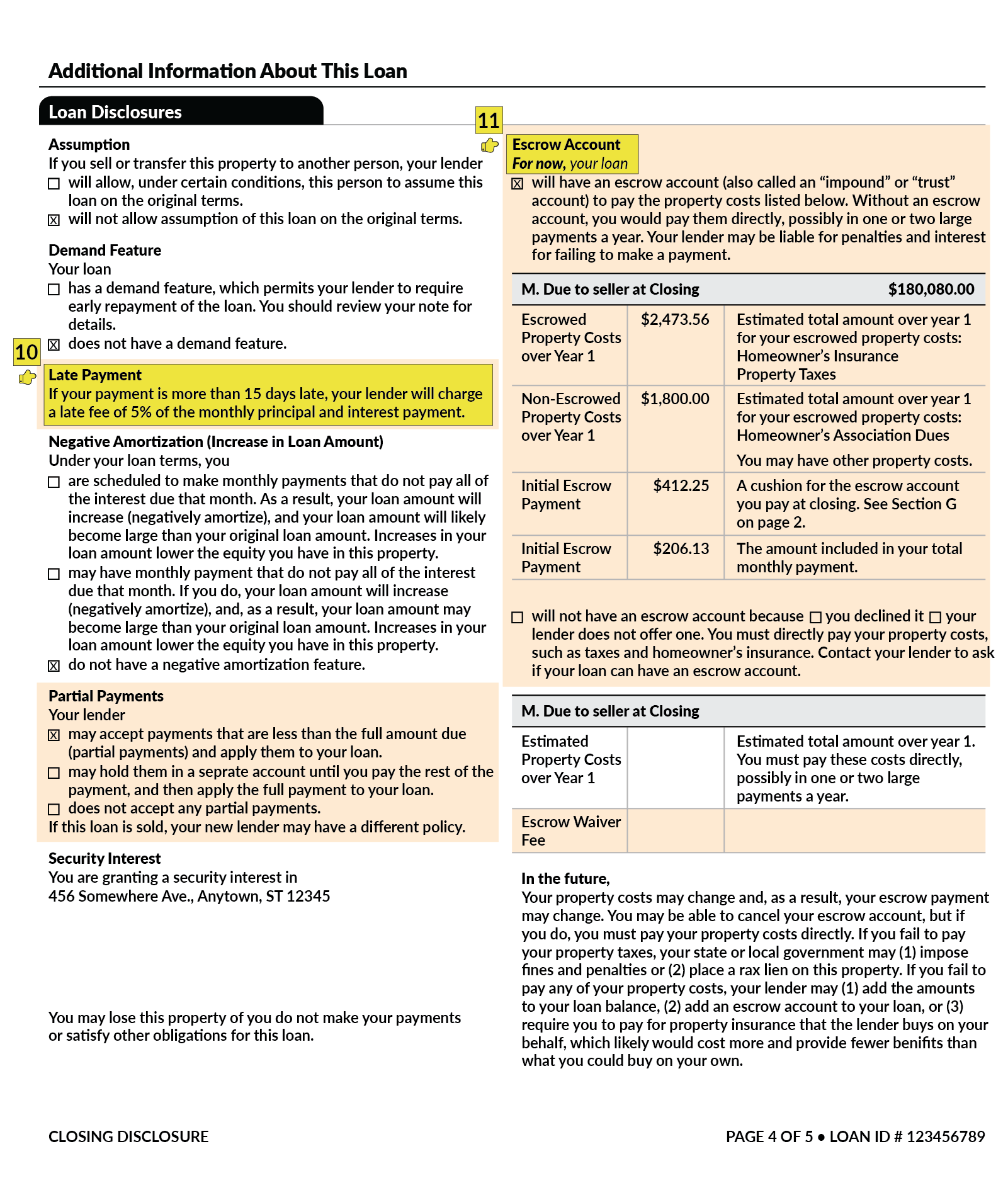

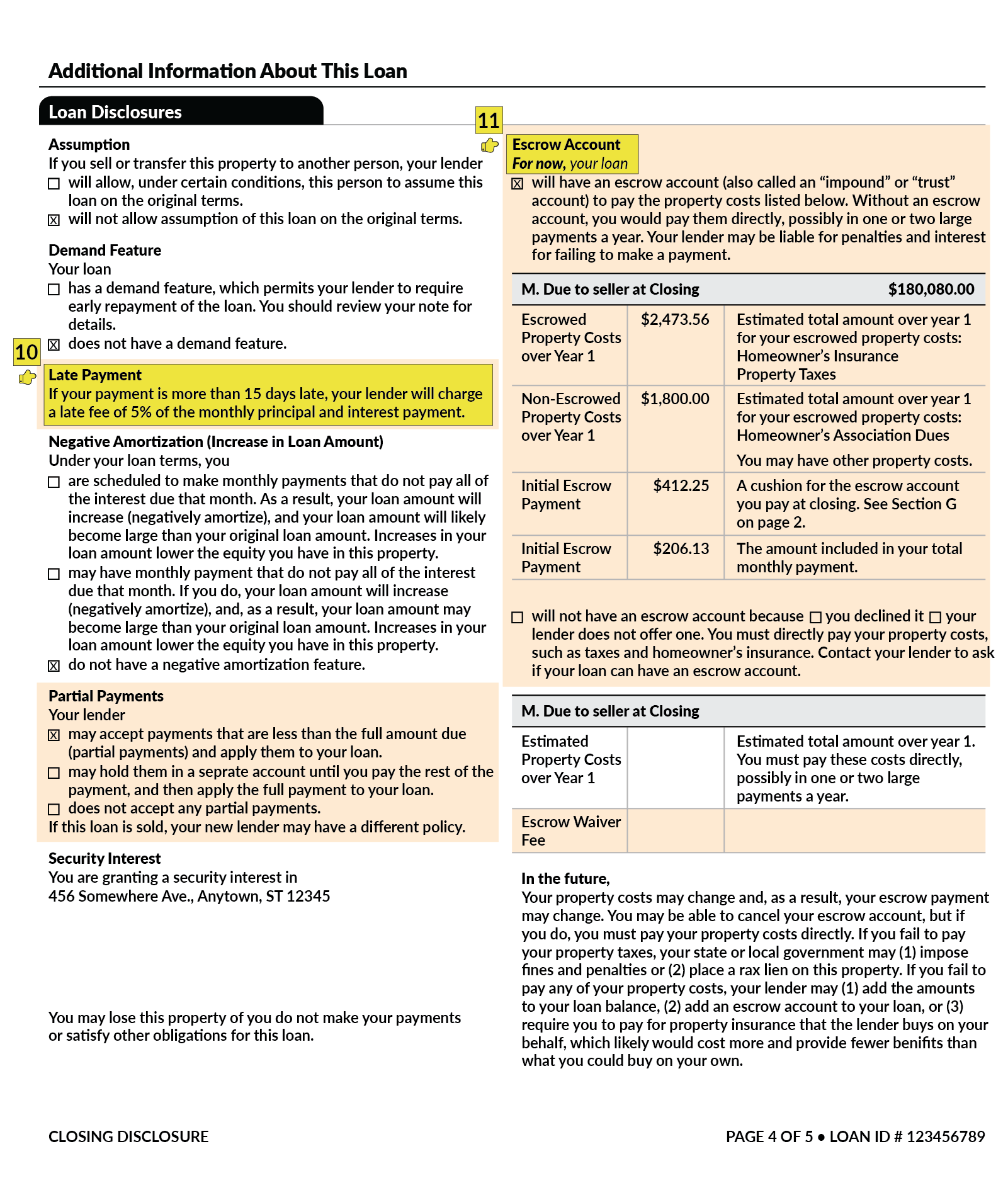

What Is A Closing Disclosure Lendingtree

Understanding Finance Charges For Closed End Credit

Federal Register Truth In Lending Regulation Z

Federal Register Facilitating The Libor Transition Regulation Z

406 Startup Failure Post Mortems

What Is A Closing Disclosure Lendingtree

:max_bytes(150000):strip_icc()/401_k_istock479882934-5bfc328f46e0fb0051bf266e.jpg)

/GettyImages-520885672-a69470168f764663a37e873e291c8b37.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-597314925-72053ed3e7d54bcca2b40d3d84937d67.jpg)